Ethereum’s price may be struggling, but institutional confidence in the asset has continued to grow.

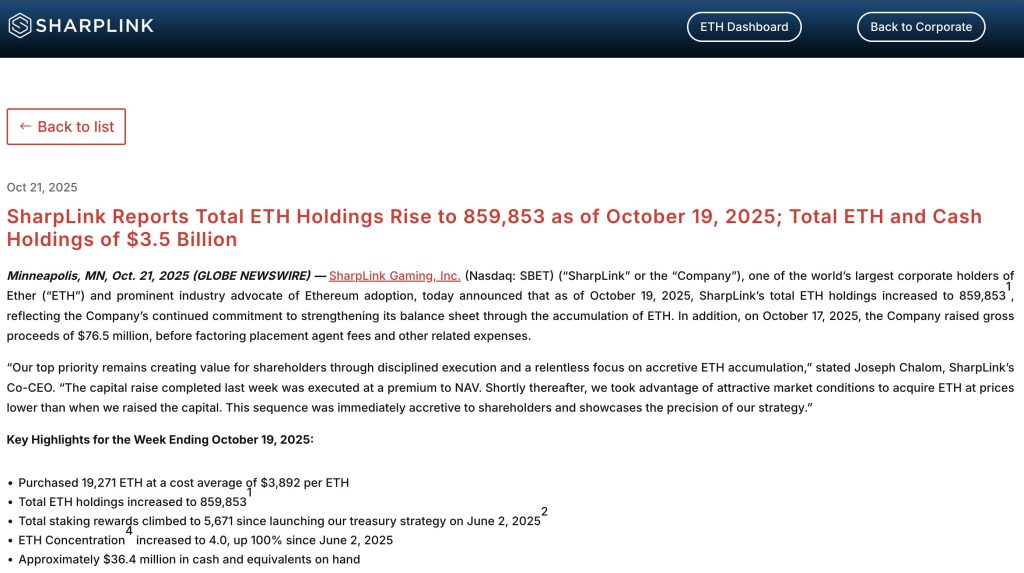

SharpLink Gaming, one of the world’s largest corporate holders of Ether, reported a sharp increase in its treasury holdings this week, adding over 19,000 ETH amid a broader market downturn.

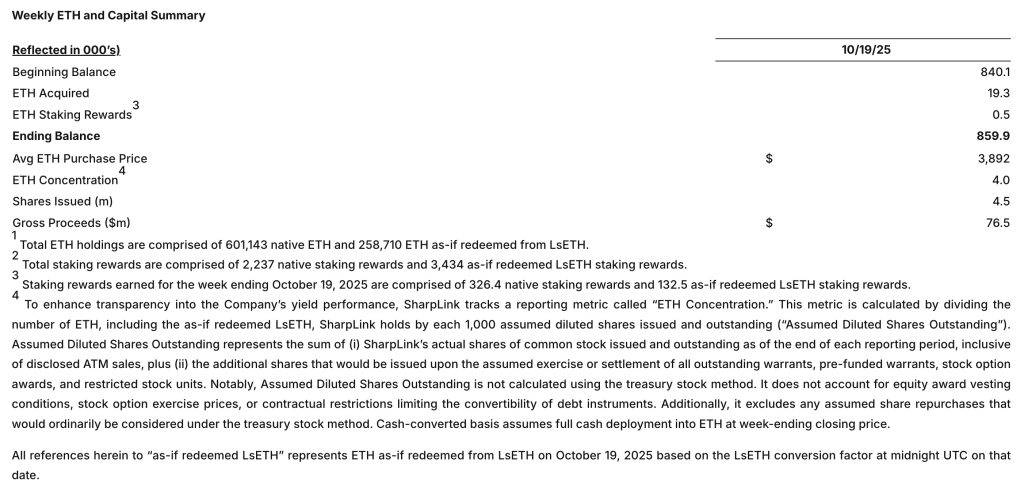

According to the company’s latest disclosure, SharpLink’s total Ether holdings rose to 859,853 ETH as of October 19, 2025, valued at approximately $3.5 billion when combined with its cash reserves.

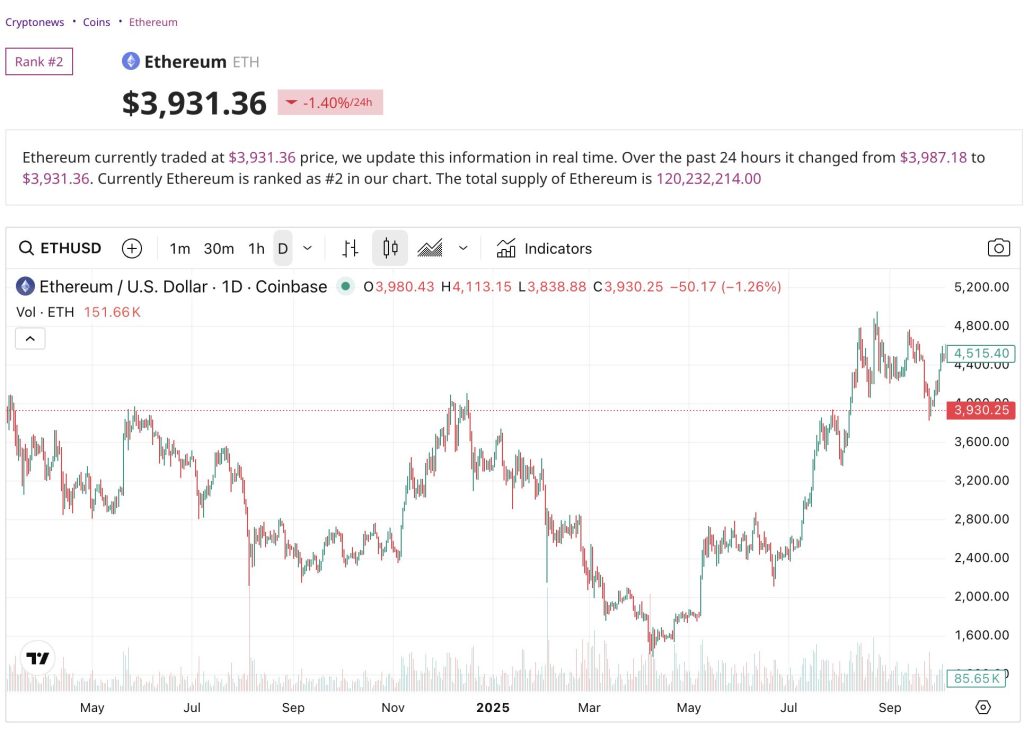

As of press time, Ethereum was trading at $3,960, down 0.7% over the past 24 hours and 12% over the past month.

The token has been falling as a result of macroeconomics, and President Donald Trump’s tariff war with China has threatened to impose tariffs of up to 155% on Chinese goods starting on November 1.

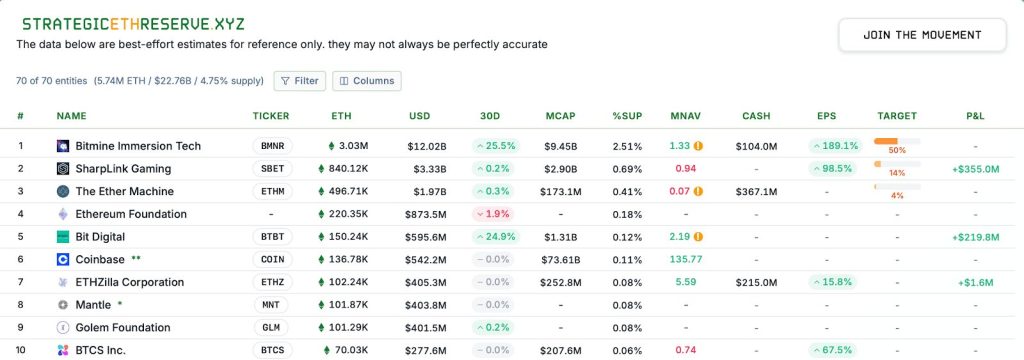

However, despite this, investors are using the opportunity to stack up their top token for when the market stabilizes, of which SharpLink is one lately, and BitMine recently too.

Last week, BitMine Immersion Technologies purchased 379,271 ETH, worth about $1.5 billion, across several transactions following the crash, raising its total holdings to more than 3 million ETH, or roughly 2.5% of all Ether in circulation.

Still, seasonal trends remain a concern, with CoinGlass data showing that the fourth quarter has historically been Ethereum’s second-weakest performing period on average.

SharpLink Doubles Down on ETH After $76M Capital Boost

SharpLink noted that it purchased 19,271 ETH during the week at an average cost of $3,892 per ETH, taking advantage of what it called “attractive market conditions” following a steep sell-off across the crypto market.

The move comes just days after SharpLink completed a $76.5 million capital raise through a registered direct equity offering priced at $17 per share, representing a 12% premium to its closing price on October 15.

The funds, raised from an institutional investor, were quickly deployed to expand the company’s Ethereum treasury.

“Our top priority remains creating value for shareholders through disciplined execution and a relentless focus on accretive ETH accumulation,” said Joseph Chalom, SharpLink’s co-CEO.

He added that the firm’s latest capital raise, conducted at a premium to net asset value, allowed SharpLink to buy ETH at lower market prices, making the purchase “immediately accretive to shareholders.”

SharpLink’s updated balance sheet shows the company now holds 601,143 native ETH and an additional 258,710 ETH as if redeemed from LsETH, a liquid staking derivative.

The firm has also accumulated 5,671 ETH in staking rewards since launching its treasury strategy in June 2025. That includes 326 native staking rewards and 132 as-if redeemed LsETH rewards earned in the latest week alone.

The company’s ETH concentration ratio, a proprietary transparency metric measuring ETH holdings per 1,000 diluted shares, has doubled since June to 4.0, reflecting a growing Ethereum-weighted balance sheet.

SharpLink said it also maintains roughly $36.4 million in cash and equivalents.

Additionally, market analysts suggest that this wave of corporate accumulation, led by firms like SharpLink and BitMine, could lay the groundwork for Ethereum’s next institutional growth phase.

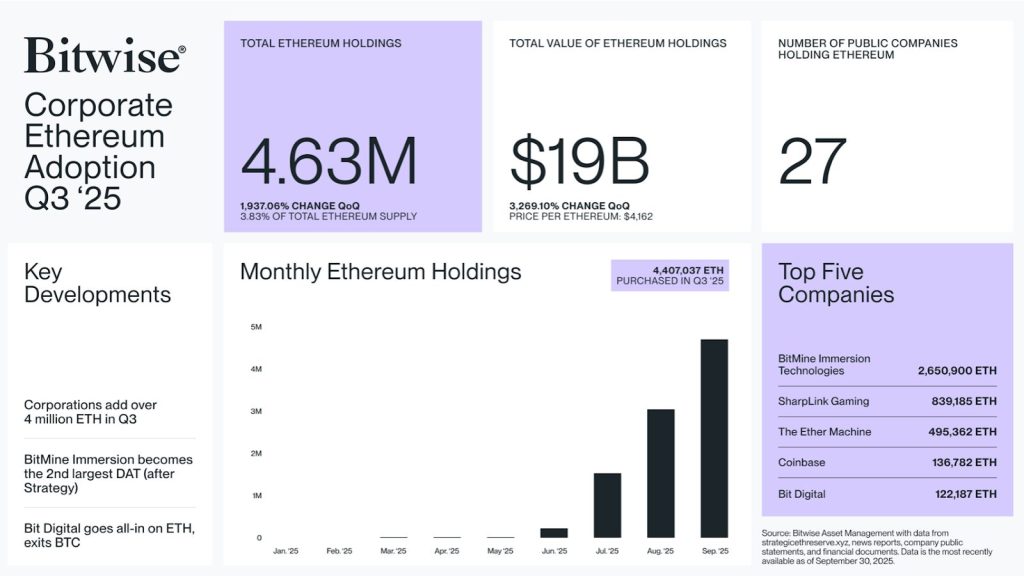

95% of Corporate Ethereum Holdings Added This Quarter, Bitwise Data Shows

Data from StrategicEthReserve.xyz shows 69 corporate entities now hold a combined 5.74 million ETH, worth around $23 billion, representing about 4.75% of Ethereum’s total supply.

SharpLink accounts for roughly 0.69% of the total, placing it among the top corporate holders alongside firms such as BitMine Immersion Technologies, Coinbase, and The Ether Machine.

Industry momentum toward Ethereum treasuries has intensified in recent months.

According to Bitwise data, 95% of all Ether held by public companies was purchased within the past quarter, with total holdings now exceeding 4.6 million ETH across corporate balance sheets.

That buying spree coincided with SharpLink’s other major announcements this fall, including a plan to tokenize its SEC-registered common stock directly on the Ethereum blockchain.

The initiative, launched in partnership with Superstate through its Opening Bell platform, seeks to demonstrate how regulated U.S. equities can be issued and held on-chain without losing their legal status.

Chalom, who recently spoke at the Digital Assets Summit (DAS) 2025 in London alongside ConsenSys founder Joseph Lubin, reinforced his belief that Ethereum remains central to the future of institutional finance.

He described the current market as undergoing a “flight to quality,” where major institutions increasingly view Ethereum and Bitcoin as “high-quality growth assets that can stand the test of time.”

“Institutions are here, they’re ready to go,” Chalom said during the panel. “But it’s going to be a flight to quality, not a flight to speculation.”

Lubin echoed the sentiment, calling Ethereum’s next phase a key moment in a “multi-trillion-dollar adoption curve” driven by tokenization, staking yields, and on-chain infrastructure.

Trending News

RecommendedPopular Crypto TopicsPrice Predictions